Overview

Provided below is a status update and summary of tariffs that have been implemented since February 1, 2025, and its impacts on imports from multiple countries.

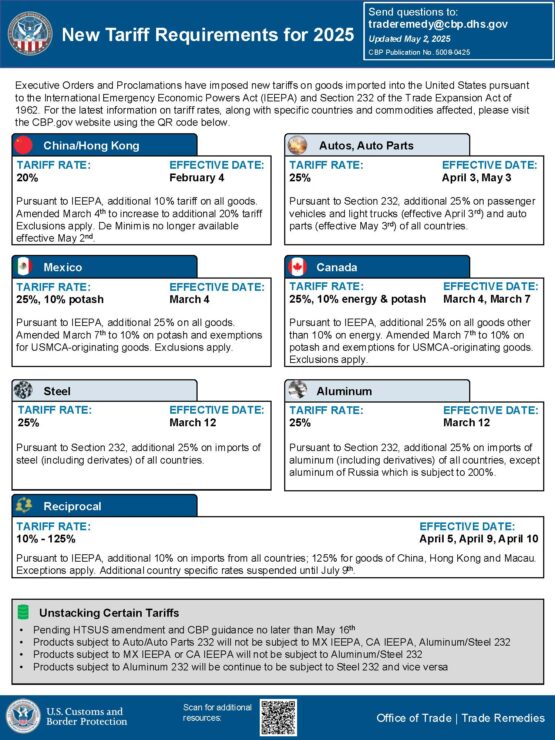

IEEPA Tariffs

IEEPA tariffs were announced on February 1, 2025 and went into effect on February 4, 2025. The current tariff burden is as follows

- Goods with Country of Origin China (including Hong Kong) 20%

Tariff rates were originally 10% and then were increased to 20% on March 4, 2025

All goods under all HTS numbers are subject to these tariffs

- Goods with Country of Origin Canada 25%

Tariffs were paused until March 4, 2025 and went into effect on March 4, 2025

Goods qualifying for USMCA treatment are excluded effective March 7, 2025

Goods subject to IEEPA tariffs are not subject to Section 232 steel and aluminum tariffs.

- Goods with Country of Origin Mexico 25%

Tariffs were paused until March 4, 2025 and went into effect on March 4, 2025

Goods qualifying for USMCA treatment are excluded effective March 7, 2025

Goods subject to IEEPA tariffs are not subject to Section 232 steel and aluminum tariffs.

Section 232 Duties on Steel and Aluminum Products and Steel and Aluminum Derivative Products

Section 232 duties on all imports of steel and aluminum subject to the HTS numbers identified in the published Federal Register notices went into effect on March 12, 2025. There are no exceptions or exclusions and all steel and aluminum as well as derivative goods are subject to these duties.

- Steel Products 25%

- Aluminum Products 25%

- Steel Derivative Products 25%

- Aluminum Derivative Products (including aluminum cans) 25%

Universal/Reciprocal Tariffs

Universal tariffs of 10% on imports of all goods from all countries. The tariffs went into effect on April 5, 2025, however, the escalated tariffs on specific list of 83 countries have been paused for 90 days until July 9, 2025.

- Goods with Country of Origin China (including Hong Kong) 125%

- Goods with Country of Origin from All Other Countries 10%

The universal/reciprocal tariffs are not applicable on the following goods which are currently subject to Section 232 duties or will be subject to Section 232 duties as part of ongoing investigations. This exemption is explicitly articulated in Section 2(b) of the Executive Order and enumerated in Annex II announcing the universal/reciprocal tariffs.

- All articles of steel or aluminum subject to Section 232 duties

- All automobiles and autoparts subject to Section 232 duties

- Copper

- Pharmaceuticals

- Semiconductors

- Lumber articles

- Critical minerals

- Energy and energy products

The 10% reciprocal tariff rate is similarly not applicable to goods from Mexico or Canada as those are subject to the 25% rate except the products qualify under the USMCA for duty free treatment.

Tariffs and Duties are Cumulative (Stacked)

The tariffs and duties summarized above are cumulative (i.e. stacked) and are not mutually exclusive. These rates also apply on top of any Section 301, antidumping and countervailing duties, and any normal duty rate. As a result, the duties and tariffs must be calculated as follows:

China

- IEEPA and Universal/Reciprocal Tariffs (China)

Normal Duty + 20% + 125% = Normal Duty + 145%

- Section 301 and IEEPA and Universal/Reciprocal Tariffs (China)

Normal Duty + 25% (301 List 1, 2, & 3) + 20% + 125% = Normal Duty + 165%

Normal Duty + 7.5% (301 List 4) + 20% + 125% = Normal Duty + 152.5%

- Section 232 Duties and IEEPA Tariffs (China)

Normal Duty + 25% + 20% = Normal Duty + 45%

- Section 301 and Section 232 Duties and IEEPA Tariffs (China)

Normal Duty + 25% (301 List 1, 2, & 3) + 25% + 20% = Normal Duty + 65%

Normal Duty + 7.5% (301 List 4) + 25% + 20% = Normal Duty + 52.5%

Canada & Mexico (non-USMCA Qualifying Goods)

- IEEPA and Universal/Reciprocal Tariffs (Canada & Mexico)

Normal Duty + 25% = Normal Duty + 25%

- Section 232 Duties and IEEPA Tariffs (Canada & Mexico)

Normal Duty + 0% + 25% = Normal Duty + 25%

All Countries

- Universal/Reciprocal Tariffs Only

Normal Duty + 10% = Normal Duty + 10%

- Section 232 Duties and Universal/Reciprocal Tariffs

Normal Duty + 25% + 0% = Normal Duty + 25%